Dynamics of the Startup ecosystem in Africa

Understanding the Startup ecosystem

The African continent is undergoing a major economic and social transformation phase

of the population is between 10 and 24 years old.

The working-age population in Sub-Saharan Africa will increase by a factor of 2.5 by 2050.

An increasing urbanization of 4% per year.

million smartphone users in 2020.

million Facebook users.

African countries among the top 20 fastest growing countries in 2015.

Internet penetration of e-commerce is set to increase significantly in the coming years

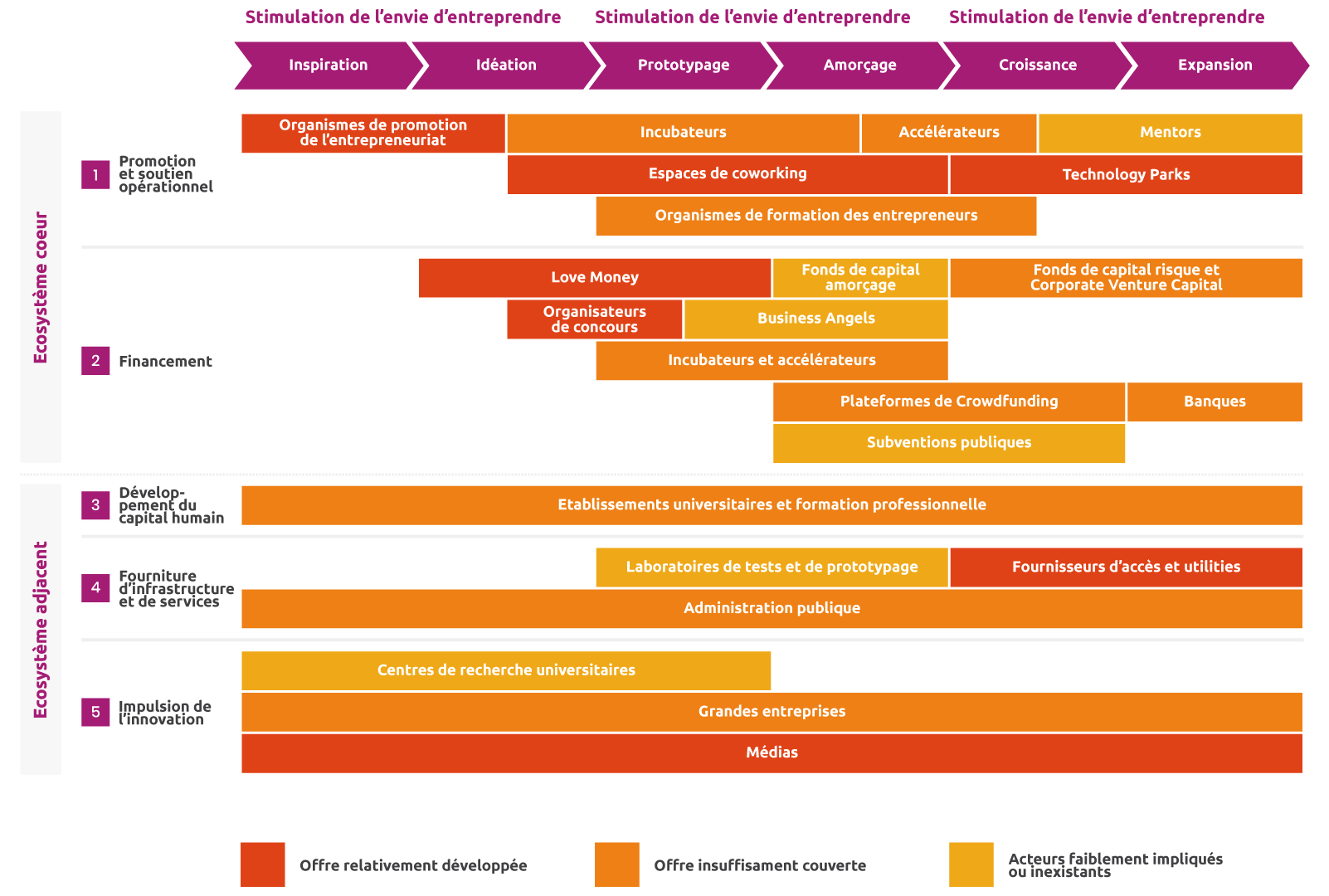

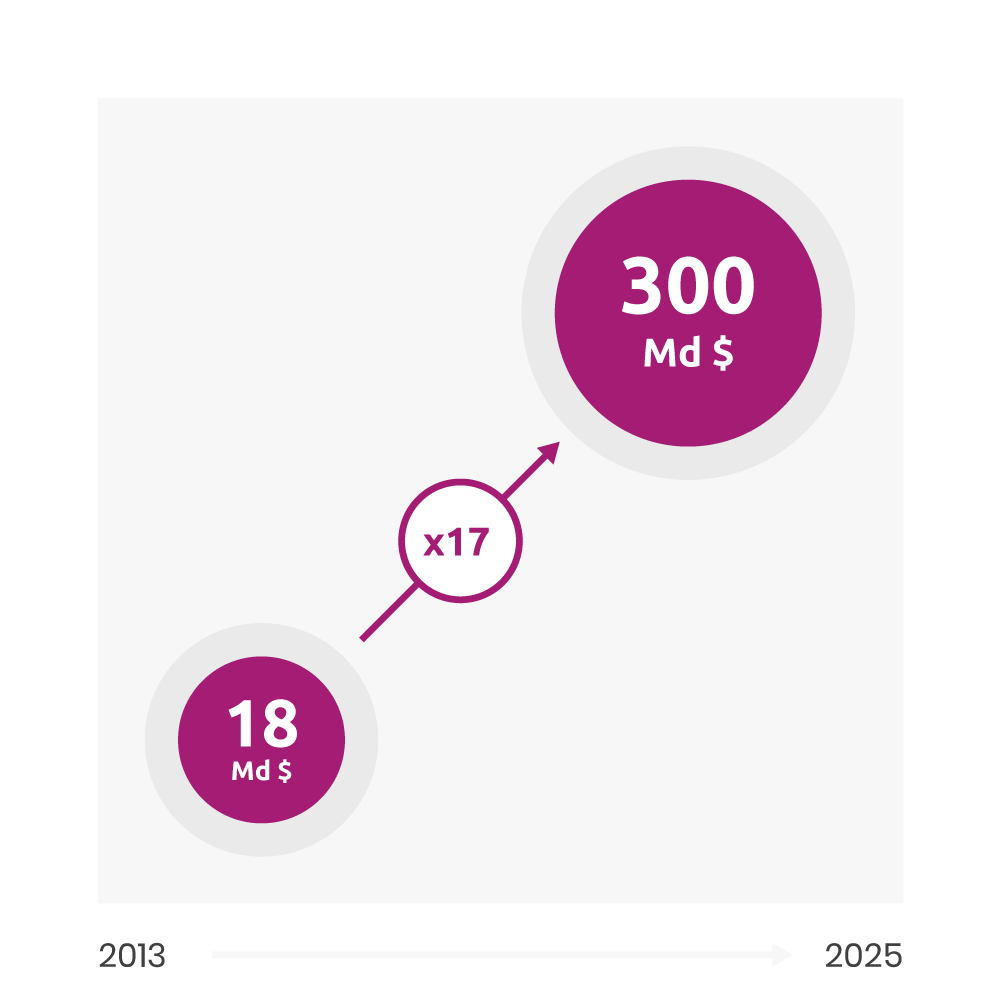

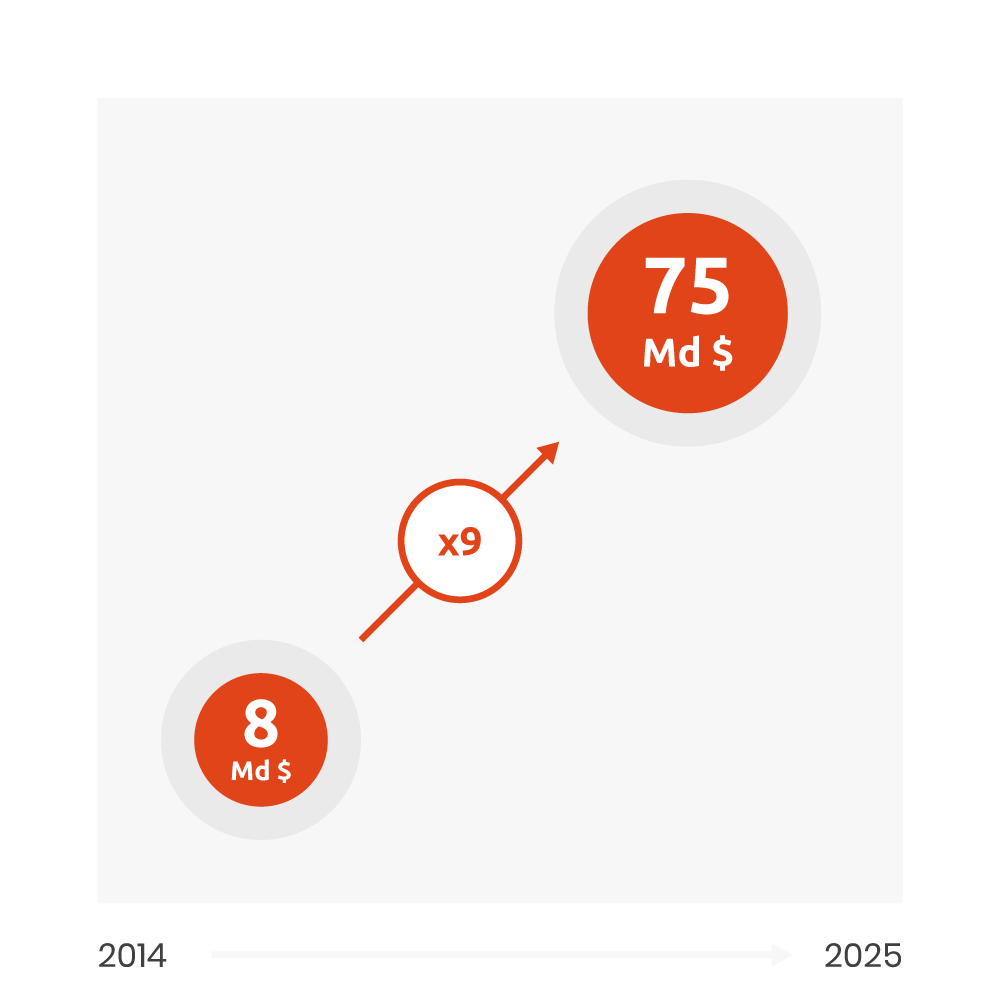

Development of the Start-up ecosystem

Comparison of the number of startups between different countries 2015

- 3

- 8

- 25

- 12

- 34

- 34

- 38

- 45

Startups created over the period 2000-2015

Main groups of countries in terms of development of the start-up ecosystem

-

74

%

Leaders from East and South Africa

Mainly English-speaking countries, leaders in terms of dynamism in startup creation and ecosystem development (e.g. Crowdfunding, mobile-Payment development).

-

-

14

%

North African locomotives

Countries closer culturally to the countries of Europe and the Middle East tend to create startups favoured by a higher level of human and technological development, and a higher rate of urbanization than the rest of the continent.

-

-

6

%

New actors from West Africa

New actors from West Africa French-speaking countries (except Ghana) with a recent dynamic in the startup sector with an impact on the whole region.

-

-

6

%

Rest of Africa

Countries with a predominantly rural population, low levels of human development and weak ICT infrastructure.

-

Start-up performances are relatively high in the leading countries of English-speaking Africa, followed by West African countries.

-

Currently, only 2 companies (AIG (a company initiated by Rocket Internet, notably holding Jumia) and Interswitch (Nigeria)) can be considered as unicorns (valuation close to USD 1 billion) at the continental level.

- > Private consumption is modelled through different penetration rates, device lifetime and mobile income share in selected industries

- > Public spending on the Internet is assumed to reach that observed in South Africa (2012) and is adjusted for inflation (4%)

- > Private investment is deducted by correlation with private consumption

- > The evolution of the trade balance will be mainly affected by exports of BPO services (business process outsourcing)

- > An activity supported by 5 countries (Morocco, Ghana, Kenya, Nigeria and South Africa) and estimated by projecting historical growth rates